Impact of Donald Trump's 2025 Tariff Policy on the IS-LM Model

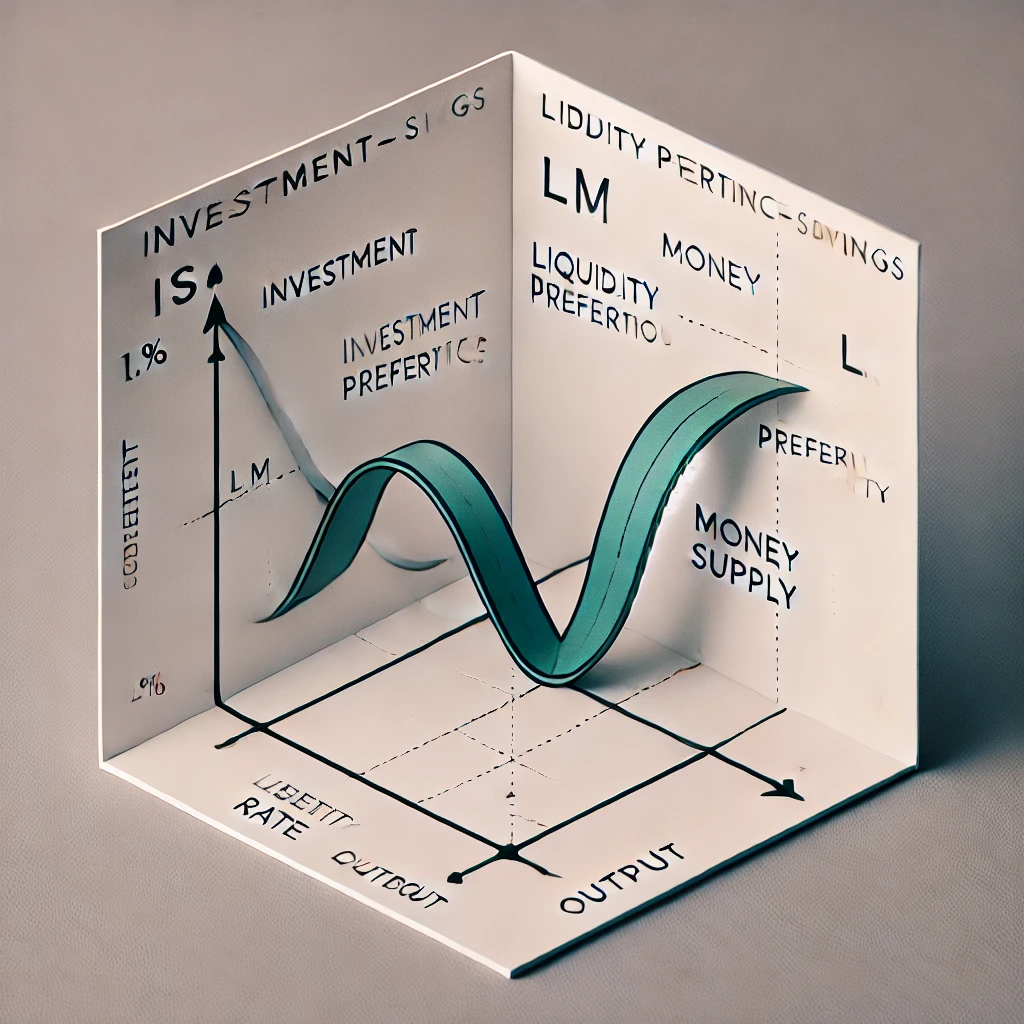

The IS-LM (Investment-Savings & Liquidity preference-Money supply) model is a fundamental macroeconomic tool used to analyze the interaction between the goods market and the money market. Developed by John Hicks in 1937 as an interpretation of John Maynard Keynes’ General Theory of Employment, Interest, and Money, this model remains relevant in understanding short-term economic fluctuations and policy implications.

Components of the IS-LM Model

The IS-LM model consists of two curves:

-

The IS Curve (Investment-Savings)

- Represents equilibrium in the goods market.

- Derived from the Keynesian Cross model, it shows combinations of interest rates and output where aggregate demand equals aggregate output.

- Downward sloping: Lower interest rates stimulate investment and increase output.

-

The LM Curve (Liquidity preference-Money supply)

- Represents equilibrium in the money market.

- Derived from the supply and demand for money, it shows combinations of interest rates and output where money supply equals money demand.

- Upward sloping: Higher output increases money demand, raising interest rates.

Equilibrium in the IS-LM Model

The intersection of the IS and LM curves determines the equilibrium level of output (GDP) and interest rates in the economy. This equilibrium reflects the balance between the goods and money markets.

Shocks and Policy Implications

-

Fiscal Policy (Government Spending & Taxation)

- Expansionary fiscal policy (e.g., increased government spending or tax cuts) shifts the IS curve rightward, increasing output and interest rates.

- Contractionary fiscal policy (e.g., reduced spending or tax hikes) shifts the IS curve leftward, decreasing output and interest rates.

-

Monetary Policy (Money Supply & Interest Rates)

- Expansionary monetary policy (e.g., increasing the money supply) shifts the LM curve rightward, lowering interest rates and increasing output.

- Contractionary monetary policy (e.g., reducing the money supply) shifts the LM curve leftward, raising interest rates and decreasing output.

Impact of Donald Trump’s 2025 Tariff Policy on the IS-LM Model

Donald Trump’s 2025 tariff policies have significant implications for the IS-LM model, particularly through their effects on trade, investment, and inflation.

-

Reduction in Net Exports (NX) → Leftward Shift of IS Curve

- Tariffs on imports reduce foreign goods’ competitiveness but also invite retaliatory tariffs, reducing U.S. exports.

- Since net exports are part of aggregate demand (Y = C + I + G + NX), a decline in NX lowers GDP, shifting the IS curve leftward.

-

Increased Uncertainty & Lower Business Investment → Leftward Shift of IS Curve

- Uncertainty in trade policy discourages business investment, especially in industries reliant on global supply chains.

- Reduced investment lowers aggregate demand, further reinforcing the IS curve’s leftward shift.

-

Higher Domestic Prices (Inflationary Pressure) → Upward Shift of LM Curve

- Tariffs increase the costs of imported goods, causing cost-push inflation.

- The Federal Reserve may respond with tighter monetary policy (higher interest rates) to combat inflation, shifting the LM curve leftward.

-

Fed Policy Response to Slowdown → Potential Rightward LM Shift

- If economic slowdown dominates over inflation, the Fed might ease monetary policy, increasing the money supply and shifting the LM curve rightward to counteract the IS curve’s leftward shift.

-

Final Outcome: Stagflationary Effects?

- If inflation dominates, the LM curve shifts leftward, reducing output and increasing interest rates (stagflation).

- If economic slowdown dominates, monetary easing shifts the LM curve rightward, mitigating output losses.

Limitations of the IS-LM Model

Despite its utility, the IS-LM model has limitations:

- Assumes a fixed price level: It does not incorporate inflation dynamics.

- Neglects international trade: It is primarily a closed-economy model.

- Simplifies financial markets: Modern economies have more complex financial interactions than the basic money market framework assumed here.

Conclusion

The IS-LM model remains a valuable framework for understanding short-run macroeconomic fluctuations and policy responses. While it has limitations, it provides foundational insights into how fiscal and monetary policies influence output and interest rates. Donald Trump’s 2025 tariff policies illustrate how trade policy interacts with macroeconomic forces, shifting both IS and LM curves in ways that policymakers must carefully navigate.